Austin Housing Market Trends: Rent Drops Nearly 20% as Vacancy Rises Sharply

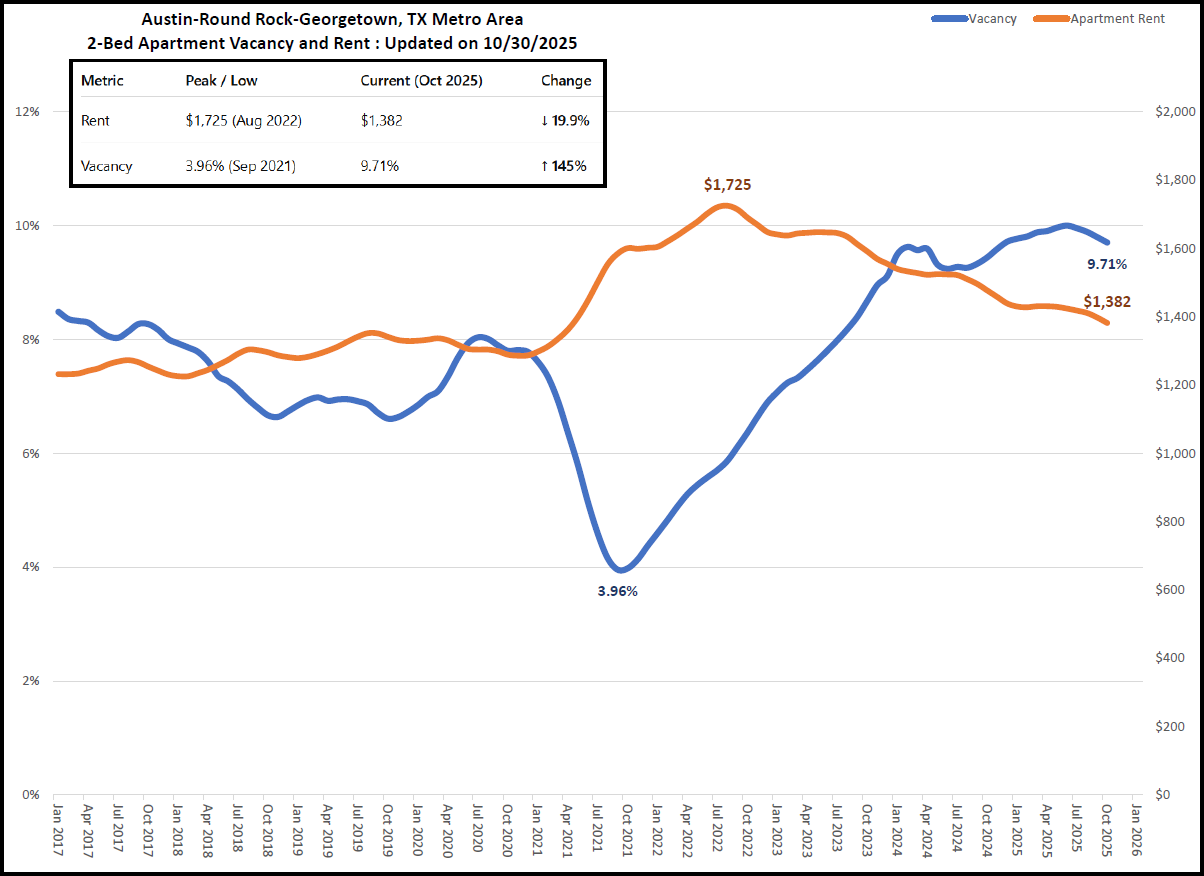

The Austin area apartment market has entered a clear rebalancing phase. After years of rent acceleration and tight supply, 2-bedroom units are now showing the strongest signs of normalization since 2016. According to Apartment List’s rent estimates data, the average rent for a two-bedroom apartment in the Austin area peaked at $1,725 in August 2022 and has since fallen to $1,382 as of October 2025—a 19.9% decline from the market high. Over the same period, vacancy rates have surged from 3.96% to 9.71%, marking a 145% increase. These twin shifts reflect both a correction in pricing and a structural adjustment in Austin’s multifamily housing balance.

A Market That Moved Too Far, Too Fast

Between 2017 and 2021, Austin’s rental market experienced a rare combination of high migration, strong job growth, and limited apartment construction. That mix pushed vacancy rates to record lows by late 2021, reaching just 3.96%—the tightest reading in nearly a decade. In response, rents accelerated at an unsustainable pace. From January 2021 to August 2022, the average two-bedroom rent jumped from $1,298 to $1,725, a 33% increase in just 20 months.

That price surge wasn’t purely demand-driven. Pandemic-era supply chain disruptions delayed thousands of apartment completions, creating temporary scarcity across the metro area. As a result, developers raced to catch up in 2022 and 2023, leading to a record wave of new supply entering the market just as economic conditions began to cool.

Oversupply Meets Moderating Demand

From mid-2023 onward, the Austin housing market began to experience a shift from scarcity to surplus. Thousands of new units delivered across the metro area—from North Austin’s Domain corridor to Round Rock and Leander—expanded available inventory faster than demand could absorb it. This supply pressure coincided with slower in-migration and tighter financial conditions, resulting in a steady climb in vacancy rates.

The vacancy rate, which averaged near 5% in early 2022, now stands at 9.71%—its highest level since before 2017. Historically, Austin’s apartment market stabilizes when vacancy sits between 6% and 7%. At nearly 10%, the market has crossed into clear “tenant-favorable” territory. Many owners are offering one to two months of free rent or lowering asking prices to attract longer lease terms. For property managers and investors, this is the first period since the pandemic when rent concessions have become common again.

Rents Have Receded, But Remain Above Pre-Pandemic Levels

While today’s $1,382 average represents a significant 19.9% drop from the 2022 peak, rents are still 6–7% above their 2019 average of around $1,300. In other words, the market hasn’t fully reversed the pandemic-era gains—it has simply corrected to a more sustainable baseline. This distinction matters because it suggests Austin’s long-term fundamentals remain intact. The city continues to add jobs and population, but at a more measured pace, giving the housing market time to digest the record-breaking construction pipeline.

Month-over-month, rents have declined steadily through 2024 and 2025, with only brief plateaus during leasing season. In fact, October 2025 marks the sixteenth consecutive month of annualized rent declines, a streak unmatched in recent Austin housing history.

The New Affordability Window for Renters

For tenants, the market reset has opened a much-needed affordability window. Average rent levels have dropped roughly $340 from the 2022 peak, bringing monthly payments closer to pre-pandemic affordability ratios. For a typical renter household earning $80,000 annually, the cost of a two-bedroom apartment has shifted from 26% of income at the peak to roughly 21% today. That’s a meaningful improvement in housing cost burden.

In practical terms, renters now have more negotiating power than at any point since 2015. Leasing agents report higher vacancy durations, and online listing platforms are displaying greater price flexibility. The 9.71% vacancy rate also means more units are available for immediate move-in, reducing competition and offering greater choice in location, amenities, and lease terms.

The Investor Perspective: Cash Flow Over Appreciation

For investors, Austin’s apartment sector has transitioned from a capital appreciation story to a cash flow one. Cap rates have expanded slightly as rents have fallen, and rising vacancy has compressed net operating income. However, this environment also creates opportunity for disciplined investors who prioritize yield stability. Acquisition costs have softened in tandem with rent reductions, and stabilized properties with long-term tenants are once again trading at more realistic price multiples.

Many investors are also adapting their underwriting to reflect the new normal—factoring in longer lease-up times, higher concessions, and slower rent growth assumptions. The short-term pain of elevated vacancy may, in time, help reestablish more balanced and sustainable market conditions.

Long-Term Outlook

The data paints a clear picture of rebalancing, not retreat. Austin’s 9.71% vacancy rate is high, but it is not unprecedented. Similar cycles occurred in 2009–2010 and again in 2016–2017 when large construction waves temporarily outpaced absorption. What differentiates the current cycle is scale: the number of units under construction during 2023–2025 reached historic highs, exceeding 40,000 across the metro area.

This oversupply will take time to absorb, likely through mid-2026, but once stabilized, the market should settle closer to its historical equilibrium—around 6–7% vacancy and moderate rent growth near 3% annually. For now, the market favors renters, but history suggests that equilibrium will return once the current inventory pipeline is fully digested.

Summary

The Austin area apartment market has shifted from one of the tightest in the nation to one of the most competitive for landlords. A 145% increase in vacancy and a 19.9% decline in rent over three years reflect both a supply surge and a cooling economy. Yet the underlying fundamentals—steady population growth, diversified employment, and continued developer confidence—point toward a market that is correcting, not collapsing.

Source: Apartment List, Rent Estimates Data https://www.apartmentlist.com/research/category/data-rent-estimates

FAQ

1. Why are Austin apartment vacancies so high in 2025?

Vacancy rates have climbed primarily because of oversupply. Developers completed a record number of new apartment units in 2023 and 2024, outpacing the rate of renter demand growth. As leasing velocity slowed, vacancies naturally increased across the Austin area.

2. Have rents in Austin fallen back to pre-pandemic levels?

Not entirely. While the average 2-bedroom rent has fallen nearly 20% from the August 2022 peak, it remains about 6–7% higher than late 2019 levels. The current pricing represents a correction to a more sustainable range rather than a full reversion.

3. Is this a good time for renters to negotiate leases in Austin?

Yes. With vacancy rates above 9%, renters are in the strongest negotiating position in years. Many landlords are offering free rent periods, reduced deposits, or flexible lease terms to attract qualified tenants.

4. How does Austin’s rental correction compare to other U.S. markets?

Austin’s 19–20% rent decline is among the largest in the nation since 2022, reflecting how aggressively the market expanded during the pandemic. Other Sun Belt metros like Phoenix and Tampa have seen similar double-digit pullbacks, though few match Austin’s scale of supply growth.

5. What’s the outlook for Austin’s apartment market in 2026?

Rents are likely to stabilize in mid-to-late 2026 as new construction slows and population growth resumes. Vacancy rates should gradually retreat toward the 6–7% range, marking the return to a balanced rental environment.