Austin Housing Market Update: How Far the Price Correction Has Really Gone

The Austin housing market has already experienced a significant price correction, but the real story only becomes clear when prices are adjusted for inflation. While headline numbers show a large drop from the 2022 peak, inflation-adjusted data reveals how close the market truly is to reaching fair value—and where meaningful opportunities and risks still exist across cities and ZIP codes.

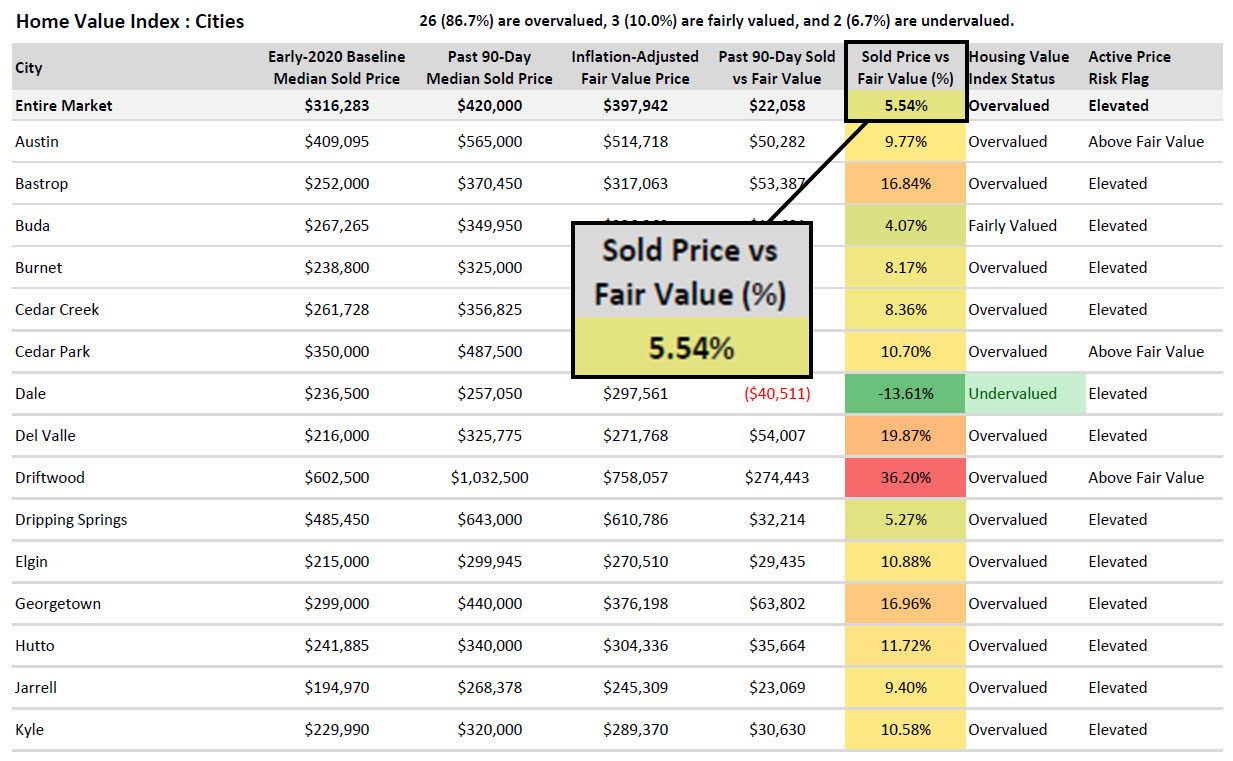

Nominally, Austin home prices have declined 24.55%, representing a drop of roughly $135,000 from peak levels. When those same prices are adjusted for inflation, the real decline is deeper at 32.16%, or approximately $176,901. Despite this substantial correction, current pricing still sits modestly above inflation-adjusted fundamentals. Based on today’s pricing relative to inflation-adjusted fair value, the Austin housing market is now approximately 85% through its real price correction, with prices still about 5.5% above where they would be if they had only tracked inflation since early 2020.

This distinction matters. Nominal price declines alone do not tell the full story in an inflationary environment. Adjusting prices back to a real, inflation-consistent baseline allows for a clearer assessment of whether the Austin real estate market is still overpriced, fairly valued, or beginning to offer genuine value.

The Housing Value Index framework anchors pricing to early-2020 fundamentals, using January through March 2020 as the baseline period. That baseline is adjusted forward using CPI inflation and then compared to the most recent 90-day median sold price. This approach avoids the noise of single-month snapshots and provides a clearer picture of where the market is clearing today relative to inflation-adjusted fundamentals.

At the broad market level, Austin remains slightly overvalued. A 5.5% premium above inflation-adjusted fair value does not signal a bubble or a renewed surge in prices, but it does indicate that the correction is not fully complete. The majority of the excess created during the 2020–2022 distortion cycle has already been worked off, yet pricing has not fully normalized on a real basis.

What makes the current Austin housing market especially important to analyze is the dispersion beneath the surface. City-wide and metro-wide averages conceal meaningful differences across submarkets. Some cities remain materially overvalued relative to inflation-adjusted benchmarks, while others have already corrected back to fair value or below. This divergence is now more pronounced than at any point earlier in the cycle.

ZIP-level data reinforces this point. While the overall Austin market remains modestly overvalued, certain ZIP codes are already trading below inflation-adjusted fair value. ZIP code 78741, for example, is currently undervalued by approximately 12.2%, meaning prices are about $50,000 below where they would be if they had simply followed inflation since early 2020. This is a clear illustration of how aggregate market narratives can miss localized pricing dynamics.

These differences matter for buyers, sellers, and investors alike. Buyers focusing only on metro-wide price trends may miss areas where real value has already emerged. Sellers relying on outdated peak pricing assumptions may find themselves misaligned with current market clearing prices, especially in submarkets where inflation-adjusted corrections are already complete.

Another important layer in the current Austin real estate market is seller behavior. In some areas, active listing prices remain above inflation-adjusted fair value even when sold prices have already adjusted downward. In other areas, sellers have begun to price more realistically, aligning active listings closer to recent closing prices. This distinction helps explain why some markets are seeing longer days on market and more price reductions, while others are stabilizing despite remaining slightly overvalued on a real basis.

From a market structure perspective, the Austin housing market has transitioned away from the extreme conditions of the pandemic era and into a phase where pricing efficiency is improving. The majority of the real correction has already occurred, but the final stage of normalization tends to be slower, more uneven, and highly localized. Broad price declines give way to selective adjustments, driven by affordability constraints, financing conditions, and buyer sensitivity to real value.

Looking ahead, the data suggests that further correction, if it occurs, is likely to be incremental rather than dramatic at the metro level. With roughly 85% of the real correction already completed, the remaining adjustment would primarily serve to close the gap between current prices and inflation-adjusted fair value. Whether that gap closes through additional price declines, sideways movement, or income growth will depend on broader economic conditions, but the largest reset is already behind us.

For those tracking the Austin real estate forecast, this environment favors precision over generalization. Understanding which cities and ZIP codes are still priced above fundamentals and which have already moved below them is now far more important than predicting the next headline price move for the region as a whole. The Austin property market is no longer moving as a single unit, and valuation differences are now driving outcomes more than momentum.

Frequently Asked Questions

How much have Austin home prices really fallen from the peak?

Nominally, Austin home prices have declined about 24.55% from peak levels, or roughly $135,000. When adjusted for inflation, the real decline is larger at approximately 32.16%, or about $176,901. Inflation-adjusted analysis provides a clearer view of how much purchasing power has actually changed in the Austin housing market.

What does it mean that the market is 85% through its correction?

Being 85% through the real price correction means most of the inflation-adjusted excess created during the 2020–2022 period has already been removed. Prices are now only about 5.5% above inflation-adjusted fair value. This suggests the largest portion of the Austin housing correction has already occurred.

Why can the Austin market still be overvalued after such a large decline?

Even after a large nominal decline, prices can remain overvalued once inflation is accounted for. Inflation raises the baseline needed for prices to be considered neutral in real terms. In Austin, prices have fallen significantly, but not quite enough yet to fully match inflation-adjusted early-2020 fundamentals.

Are there areas in Austin that are already undervalued?

Yes. While the overall Austin market remains slightly overvalued, some ZIP codes are already trading below inflation-adjusted fair value. ZIP code 78741 is one example, currently priced about 12% below its inflation-adjusted benchmark, highlighting localized value opportunities.

Does undervalued mean prices will rise from here?

Not necessarily. Undervalued in this framework means prices are below an inflation-adjusted baseline, not that prices must rebound. Markets can remain below fair value for extended periods depending on affordability, interest rates, and demand conditions within the Austin real estate market.