Overview of 2024 Building Permit Activity

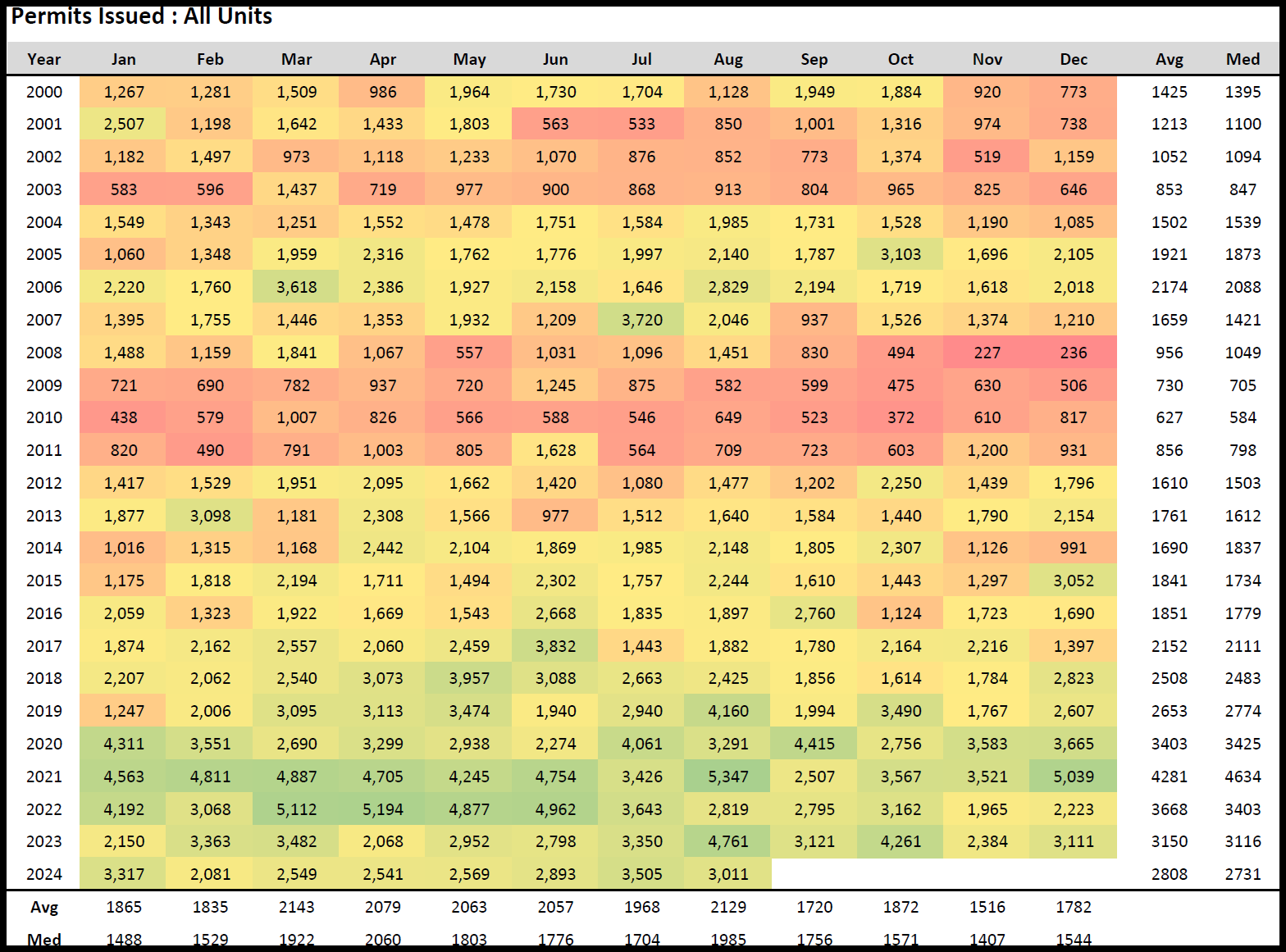

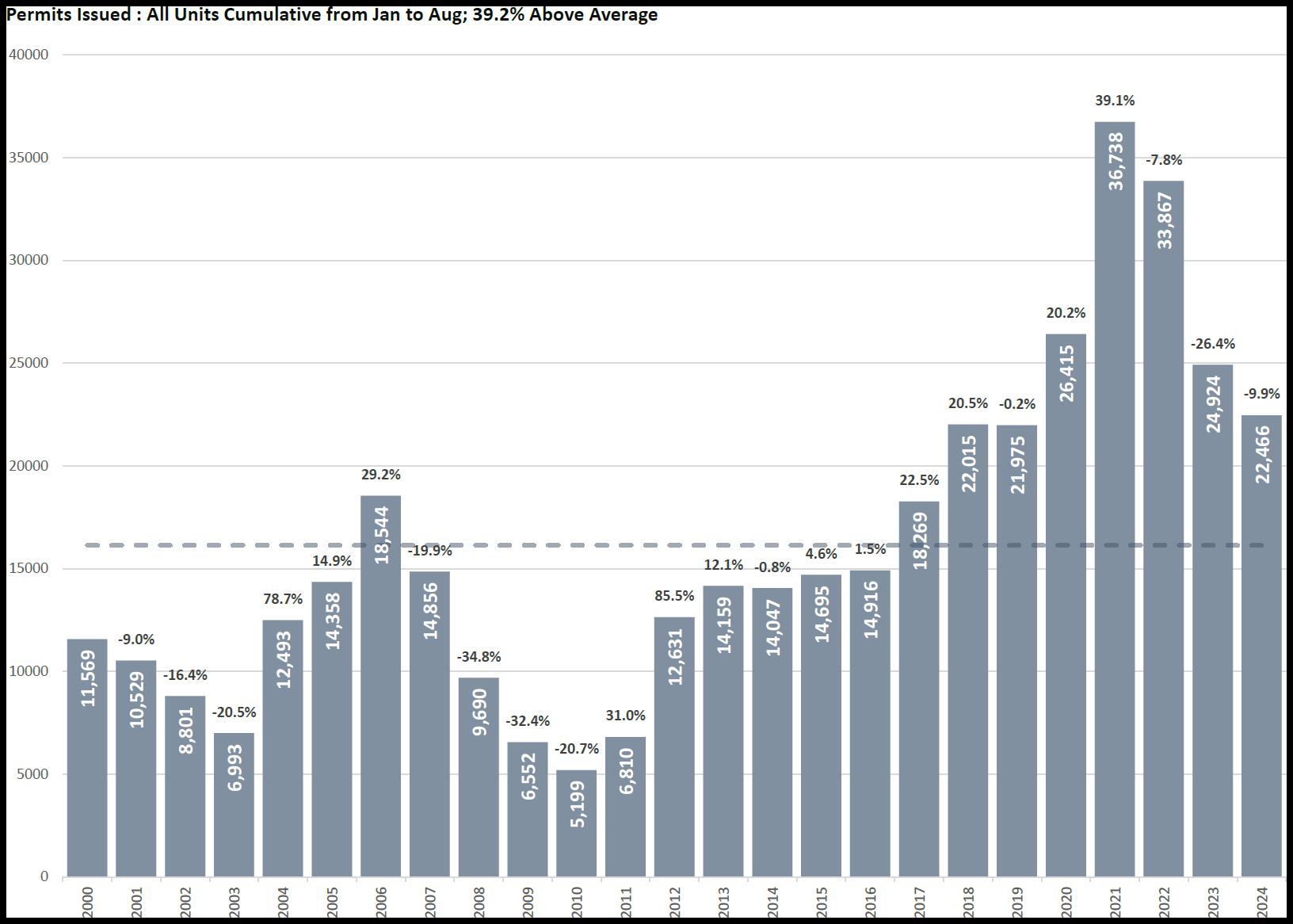

As of August 2024, the total number of building permits issued across all units in the Austin area was above historical averages, reflecting continued robust construction activity in the region. Through August, the cumulative total of building permits was 39.2% higher than the long-term average, suggesting sustained demand for residential development. However, there were month-to-month fluctuations, with certain months performing below expectations, such as April and May. This pattern mirrors some volatility in the Austin real estate market, where both demand and economic conditions influence building activities.

Breakdown by Units

Single-Unit Permits: The demand for single-family homes in Austin has continued to drive a significant portion of building permit applications. The data shows a steady issuance of permits for single-unit properties, with the year-to-date figures remaining stable compared to previous years. Although not dramatically above historical averages, the issuance of permits for single-unit properties reflects a steady housing market.

2-4 Unit Permits: Permits for 2-4 unit developments have shown a modest increase compared to the previous year but still represent a smaller share of total building permits. This category typically reflects smaller multifamily developments, such as duplexes or triplexes, which are often favored in urban areas for their affordability and density.

5+ Unit Permits: Larger multifamily developments (5 or more units) have shown significant growth in 2024, particularly during the summer months. August, in particular, saw a marked increase in permits issued for 5+ unit buildings, reflecting the ongoing demand for apartments and condominium developments in the Austin area. This trend aligns with the growing population and the need for higher-density housing solutions in the metropolitan area.

Month-by-Month Trends in 2024

The report provides a monthly breakdown of building permit issuance, allowing for a closer examination of construction trends. Some key observations include:

January: The year began with a relatively strong issuance of building permits, with over 3,000 permits issued, reflecting a continuation of momentum from 2023.

April-May Decline: In contrast, April and May saw a drop in permit issuance compared to the early months of the year. These months registered permit counts closer to the historical averages, suggesting a temporary cooling of the market.

Summer Surge: The summer months of July and August saw a resurgence in building activity, with permit numbers spiking, particularly in the multifamily housing sector. August was notable for being 41.4% above the long-term average for that month, emphasizing the strong seasonal demand for housing in the Austin area.

Population-Adjusted Trends

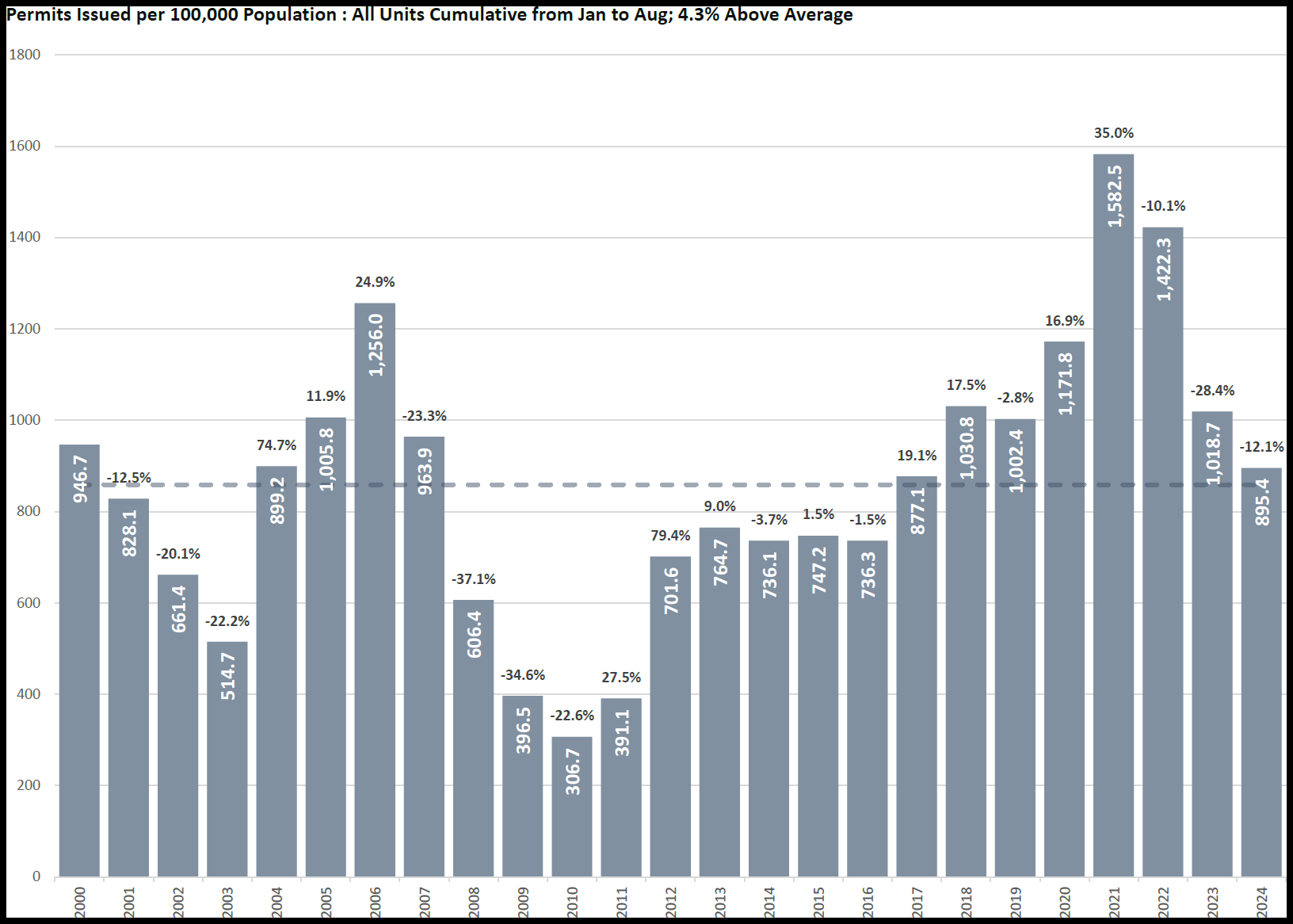

One significant feature of the report is its adjustment of building permit data relative to the population size of the Austin area. This adjustment is crucial in understanding whether the level of building activity is proportional to the city's growth. The report notes that permits issued per 100,000 people for the month of August 2024 were 7.1% above the historical average, indicating that, on a per capita basis, construction activity is outpacing population growth. Cumulatively, from January through August 2024, the number of permits per 100,000 people was 4.3% above average, further underscoring that Austin is experiencing an above-average rate of construction relative to its population growth.

Historical Context

Looking at the historical data, several long-term trends emerge:

Early 2000s Boom: The Austin area saw a sharp increase in building permit issuance during the early 2000s, peaking in 2006. This period was characterized by rapid population growth and economic expansion, leading to heightened demand for housing.

2008 Recession Impact: The global financial crisis in 2008 significantly impacted the housing market in Austin, as reflected in the sharp decline in building permits during 2009 and 2010. The report shows that the issuance of permits during this period fell dramatically, with some months seeing as few as 200-300 permits issued.

Post-Recession Recovery: After bottoming out in 2010, building permit activity slowly recovered. The recovery gained pace after 2012, with 2020 being a particularly strong year for permits issued. This period of growth coincides with Austin’s rise as a major tech hub, drawing an influx of new residents and spurring housing demand.

Pandemic Surge: 2020 and 2021 were exceptional years for building permit issuance, reflecting the strong demand for housing during the pandemic. The report highlights that these years were well above the long-term average, with certain months in 2021 seeing record-breaking numbers of permits issued.

Current Economic Factors

The surge in building permit activity in 2024 must also be understood in the context of broader economic conditions. Several factors are likely influencing the continued high demand for residential construction in Austin:

Population Growth: Austin remains one of the fastest-growing metropolitan areas in the United States, attracting both domestic and international migrants. The influx of new residents has put pressure on the housing market, driving both prices and the need for new construction.

Job Market Strength: Austin’s economy continues to perform strongly, particularly in the tech sector, where companies such as Tesla, Apple, and Oracle have expanded operations. The strength of the local job market is a key driver of housing demand, as new workers relocate to the area.

Interest Rates: While rising interest rates have cooled some housing markets across the U.S., Austin’s demand for housing remains resilient. However, the report notes some fluctuations in building permit issuance, which may reflect the uncertainty caused by changing interest rates. Higher borrowing costs can dampen demand for new housing construction, especially in more expensive markets.

Conclusion : The Austin-area building permit data for 2024 indicates that the region is experiencing robust construction activity, with the issuance of permits well above historical averages. Both single-family homes and larger multifamily developments are contributing to the growth, reflecting the diverse housing needs of the region’s expanding population. While there have been some monthly fluctuations, the overall trend points to a resilient market, bolstered by strong economic fundamentals. As Austin continues to grow, the demand for new housing is likely to remain strong, with building permits serving as a key indicator of future development and real estate trends in the region.